![]() By Denis Tanguay *

By Denis Tanguay *

The successful expansion of energy efficiency projects globally rests upon unlocking funds from private banks and investment funds. But the scaling up of energy efficiency measures, particularly in commercial buildings, requires a sound understanding of financing mechanisms adapted for the private sector. Local banks and financial institutions need more guidance and expertise to feel comfortable lending money on a cash-flow basis to energy efficiency projects. EVO published the International Energy Efficiency Financing Protocol (IEEFP) in 2009 to bridge the gap between funding sources and their financing of energy efficiency projects.

Updated in 2020 and now available in English, French, and Spanish, the IEEFP is a blueprint that provides concepts and guidelines to facilitate an understanding by loan, risk, and credit officers of the key elements needed to evaluate and deliver attractive energy efficiency project loans to facility owners, ESCOs, and other potential developers and implementers of energy efficiency projects. The IEEFP is complemented by specific country annexes covering local regulations affecting energy efficiency project financing.

Why do we bother about energy efficiency?

If nothing else, for obvious economic reasons. Energy consumption can represent – but not always – a significant cost for commercial and institutional buildings and manufacturing and industrial facilities. But we should be conscious of energy efficiency for climate considerations and its impact on GHG reductions.

In 2015, the Paris Agreement set an overarching goal of holding “the increase in the global average temperature to well below 2oC above pre-industrial levels” and pursuing efforts “to limit the temperature increase to 1.5oC above pre-industrial levels.”

At the COP 26 held in Glasgow in 2021, scientists concluded that the pledges made in Paris had the world on track to a 2.7-3.7oC temperature rise. Additional commitments were made in Glasgow, and if fully implemented, it is estimated that the warming could be kept below 2oC. Only with further actions over the next decade could the 1.5oC goal set in Paris be attained.

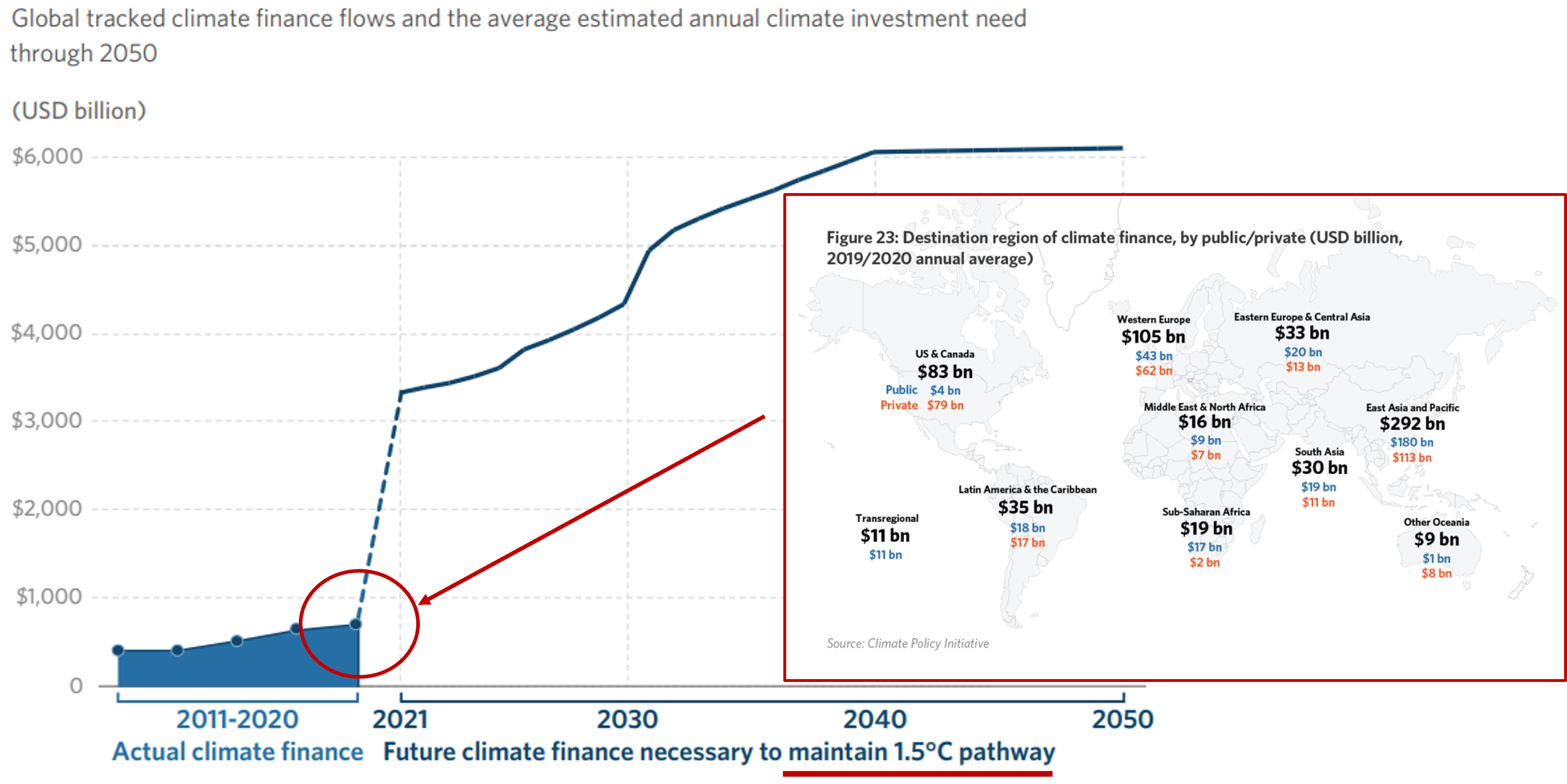

The Climate Policy Initiative reported that the total climate finance accounted for $633 billion in 2019-20, split evenly between public and private investments. To maintain the 1.5oC pathway, the group reported that climate finance must be multiplied significantly in the next decade to reach $6,000 billion annually by 2040.

https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/

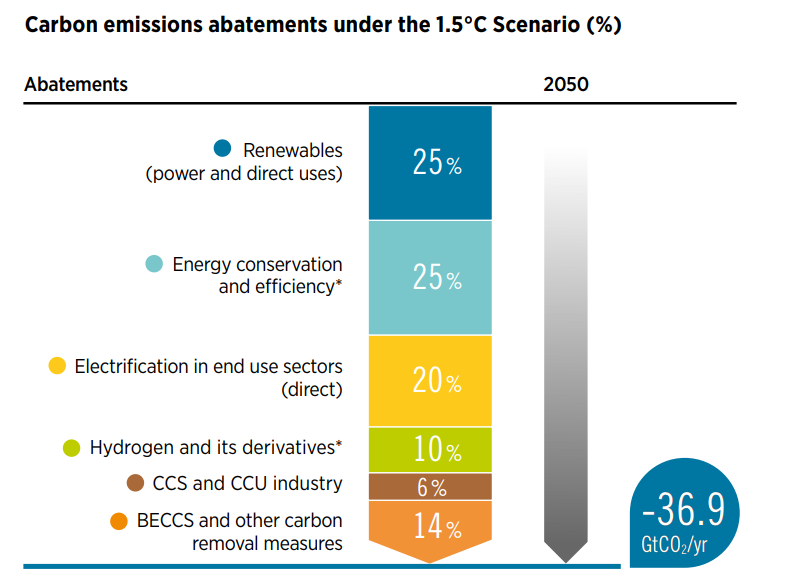

IRENA suggested in 2021 that energy conservation and efficiency could contribute up to 25 % of the carbon emissions abatements under the 1.5oC scenario. Renewables could contribute another 25 % and electrification in the end-use sectors another 20 %.

Against the backdrop of these scenarios, we see a tightening of the global energy supply. In many regions of the world, there are concerns about the security of supply, price volatility, and supply chain disruptions. This triggers deep concerns about short-term energy savings but also for longer-term energy efficiency measures and projects.

Decarbonization is also driving renewed interest in energy efficiency. We observe a more vigorous regulatory response with strict obligations to reduce energy consumption and demand. Financial institutions are also increasingly acting and considering adopting accounting methodologies for their financed GHG emissions.

And finally, there is an increased interest in measured and credibly demonstrated energy savings. Project funders require hard evidence that the savings are real, and everyone is looking for risk reduction methodologies.

Long-standing global energy efficiency barriers

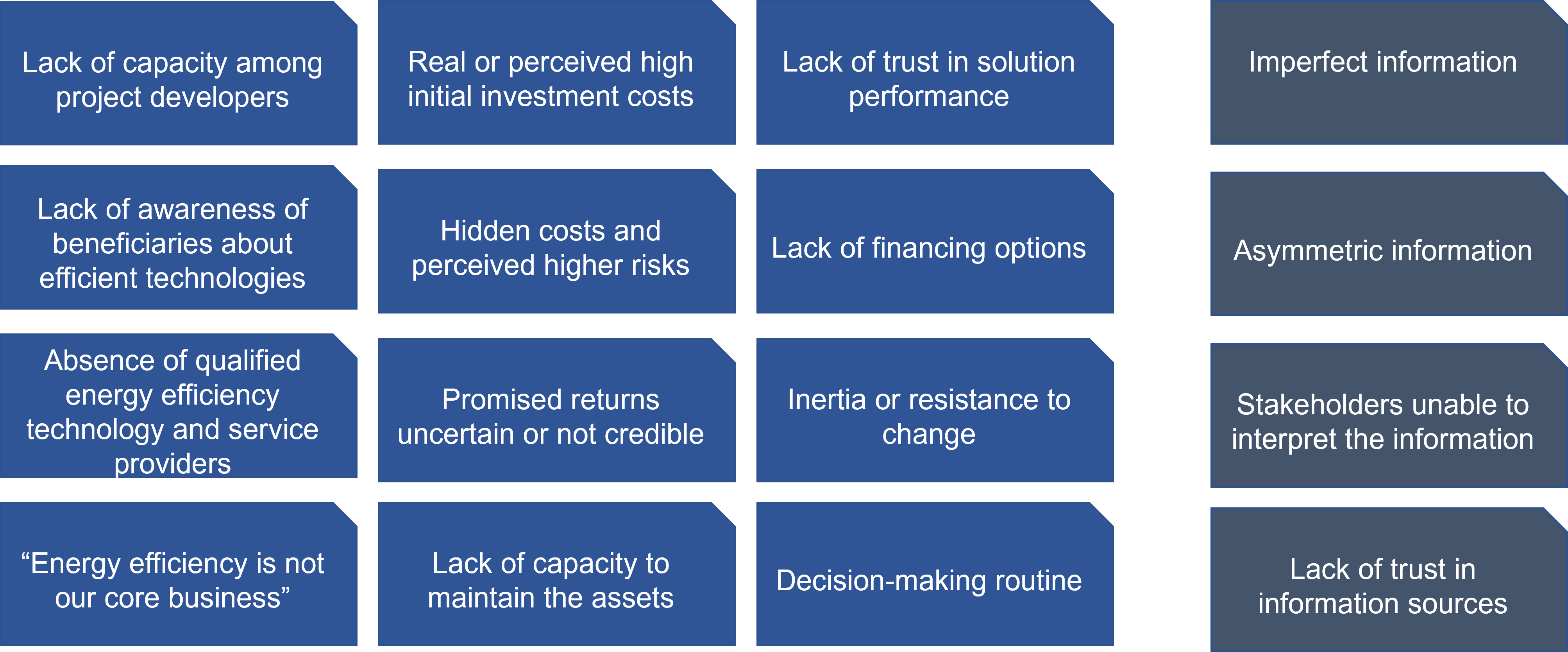

The list of barriers to implementing energy efficiency projects is long and ranges from lack of resources and capacity to needing more trust in solution performance, inertia or resistance to change, or simply to decision-making routine. The illustration below presents a sample of 16 such barriers. Readers can add to this list based on their field experience.

Among these barriers, those related to information are particularly relevant. Information is one of the critical elements of decision-making. If the information is imperfect or asymmetric, economic agents will either make wrong decisions or not make any decision if they cannot interpret the information or do not trust the information they receive.

This situation can easily lead to a general apathy towards energy efficiency, enhanced by facility owners' competitive allocation of funds. When energy efficiency projects are seen as infrastructure investments, the “don’t fix it if not broken” often justifies inaction. Also, most projects are seen as too small to bother with and distracting from the facility’s core business.

Interestingly, the need for more available funds is generally not a barrier to energy efficiency projects. The problem is, instead, that these funds cannot be accessed from the most cost-effective local sources – banks – on commercially attractive terms. This situation is caused by a certain disconnect in the banks’ and financial institutions’ lending practices versus the needs of facility owners, ESCOs, and other energy efficiency project developers.

Commonly, banks provide corporate asset-based lending limited to about 70 % of energy efficiency project capital costs, assuming a 30 % equity investment in the project and 100 % collateral or guarantee on the loan amount.

As M&V specialists know, the only collateral value of an energy efficiency project is savings. And since the savings are the absence of energy consumption, it takes a phenomenal leap of faith for a banker to consider the absence of something as collateral! Understandably, banks need more confidence in savings, which explains why they are not inclined to increase the credit capacity of facility owners.

There is also limited interest in financing energy efficiency projects due to the low volume of projects, the relatively small transaction involved, and the complexities and inability to evaluate the risks and the benefits. Banks will thus typically offer short-term loans from the existing line of credit or when fully collateralized with additional “material” assets.

Banks need help to provide attractive energy-efficiency project finance. The local financial institution cannot address some of these challenges. For example, higher provisions requirements for project finance, regulations for risk categorization of equipment as collateral by the head office, and general regulatory environment. This later point inevitably defines the boundaries of energy efficiency financing products or programs, impacting its terms and conditions.

On the other hand, some challenges can be addressed at the bank level.

- Limited energy efficiency knowledge and capacity

- Projects are not appealing (small and complex)

- Projects are not “business as usual” (Project-based)

- Insufficient collateral

- No confidence in future cash flow

- Insufficient loan applications and investment grade audits due to lack of energy efficiency project development capacity by local consultants, ESCOs, etc.

All these challenges are information and education related. With adequate exposure to relevant guidance and educational material, local financial institutions can confidently expand into a new line of business while creating wealth in their communities. This is what the IEEFP aims to do.

The International Energy Efficiency Financing Protocol (IEEFP)

The IEEFP was designed to create an understanding for local financial institutions of how energy efficiency projects generate reliable cost reductions (savings) in a facility’s existing operating expenses. To accomplish this, IEEFP is structured to enhance the credit officer’s knowledge of the following:

The IEEFP was designed to create an understanding for local financial institutions of how energy efficiency projects generate reliable cost reductions (savings) in a facility’s existing operating expenses. To accomplish this, IEEFP is structured to enhance the credit officer’s knowledge of the following:

- How energy efficiency project savings can be relied upon for loan repayment and increase the facility owner’s credit capacity.

- How to evaluate and mitigate risks of energy efficiency projects delivering the estimated savings (ignoring any attempt to educate them on assessing borrower credit risk since they should already possess this core competency).

- How to structure a project-based loan that minimizes risk and provides an attractive internal rate of return.

- How the measurement and verification (M&V) of energy savings can be reliably performed is critical to documenting and ensuring sustainable EE savings.

More specifically, the protocol provides insights regarding key aspects and savings risks of the major proven energy efficiency technologies typically implemented in retrofit projects within buildings and industrial facilities. It briefly overviews the typical process followed by facility owners, ESCOs, and project developers in developing and financing an energy efficiency project. It also discusses the requirement for a properly prepared investment-grade audit as a critical step for an energy efficiency project to be successfully implemented.

A chapter explains how M&V is the meter of an energy efficiency project and thus is critical to documenting the achieved savings and the resulting internal rate or return of an energy efficiency project investment. The role of various stakeholders involved in implementing an energy efficiency project is also emphasized. A review of the most common contracts facility owners use to develop, finance, implement, and operate an energy efficiency project is complemented by explanations on how energy efficiency project financing needs to be provided on a project versus corporate basis to be attractive to facility owners, ESCOs, and other project developers.

The last section of the document presents a detailed discussion of projects’ performance risks and mitigation strategies at different levels. It focuses on credit risks (in opposition to performance risks) and discusses various products, including partial credit guarantees and energy savings insurance. A series of checklists that credit and loan officers can use are also proposed.

The IEEFP provides concepts and guidelines to facilitate an understanding by loan, risk, and credit officers of the key elements needed to evaluate and deliver attractive efficiency project loans to facility owners, ESCOs, and other potential developers and implementers of EE Projects. The protocol is intended to differ from a training manual or a comprehensive document explaining all aspects of energy efficiency, projects, or related financing.

IEEFP Training Program

Learning how to apply the concepts and guidelines in the IEEFP can be acquired by attending EVO’s IEEFP Training Program, which provides hands-on training on using specific tools, project-based templates, and materials provided as part of the program. This program was piloted in Canada in 2020 and then in Mexico in 2021, and it is now market-ready for global deployment.

As pre-course requirements, trainees must complete two self-taught courses. An introduction to financial terms used and applied in energy efficiency projects and an introduction to the most common energy efficiency technologies.

The core program is delivered in 12 modules over two days and is concluded with a practical loan application group exercise. As an option for a deeper understanding of EE project financing, there is an additional advanced cash flow analysis course over two days, including a certification exam.

Conclusion

Some may argue that there is no market failure per se in energy efficiency. But for sure, there is an efficiency gap reflected by what is economically feasible in terms of investments and what is currently being done. Many market barriers explain this gap.

Instilling a new paradigm for financing energy efficiency projects requires market transformation. Just as the IPMVP created a paradigm shift in the 1990s for measurement and verification, the IEEFP provides critical guidelines to help achieve a market transformation for energy efficiency project financing or work in this direction.

We must help bank and loan officers enhance their capacity to interpret the information provided on energy efficiency projects and, crucially, instill trust in the sources of information. The IEEFP addresses most of the information-related barriers discussed in this article, including the problem of asymmetrical information.

![]()

(*) Denis Tanguay is the Executive Director of EVO

The IEEFP is free for download from EVO’s website. Please login into your account and visit the library available in the top menu once the login is complete. You can create an account at the following link if you do not have an account yet. https://evo-world.org/en/subscribe-join-en